kiera mortgage group at nexa lending

Kiera Thomas

Mortgage Loan Officer (NMLS #1982562)

Tools to Help You Plan for Homeownership

I’m a mortgage loan officer. Start with my free mortgage calculator to see your numbers, then grab my $5 budget and savings tools to stay on track toward buying a home.

Loan Programs

"Buying a home is easier when you know your options.

Conventional Loans

Standard loans not backed by the government, great for buyers with good credit and stable income.

VA Loans

Loans for eligible veterans and active-duty military with no down payment and no mortgage insurance.

USDA Loans

Zero-down loans for homes in eligible rural or suburban areas with income limits.

HELOC (Home Equity Line of Credit)

A revolving credit line that lets you borrow against your home’s equity as needed.

DSCR

(Debt Service Coverage Ratio) Loans

Designed for real estate investors; qualification is based on your property’s rental income, not personal income.

Bank Statement Loans

Use your bank deposits instead of tax returns to qualify—perfect for self-employed borrowers.

Down Payment Assistance Programs

Offer grants or loans to help with your down payment or closing costs.

HomeReady Loans

Fannie Mae’s program for low-to-moderate income buyers with flexible credit and income options.

Home Possible Loans

Freddie Mac’s version of HomeReady, helping buyers with limited income and small down payments.

Jumbo Loans

For homes that exceed standard loan limits, often used for luxury or high-cost properties.

FHA Loans

Government-insured loans with low down payments, ideal for first-time or credit-challenged buyers.

Cash-Out Refinance

A type of mortgage refinance that allows a homeowner to convert a portion of their accumulated home equity into a lump sum of cash

Let’s Partner to Help More Clients

"Buying a home is easier when you know your options.

Realtors Unplugged

Get insights on unique loan programs to better serve your clients

I PROVIDE LEADS

Let’s discuss a free custom strategy to grow your business together

LOAN OFFICER + REALTORS

Interested in being dually licensed as a Realtor and Loan Officer?

WHAT OUR CLIENTS ARE SAYING

Juan Rabago

Kiera Thomas is absolutely amazing! She went above and beyond to ensure my family got the best possible outcome. She truly fought for us every step of the way, never taking ‘no’ for an answer and always putting our needs first.

Tiana Thompson

I closed March 19th and I have nothing but good things to say about Kiera!! From the very beginning to the end, she was 100% honest with me about EVERYTHING! And if we had a question or needed clarification, she was always there to call or text.

Karen Washington

I contacted Kiera Thomas to learn more about refinancing my home, and the best way to purchase an investment property. Kiera is very knowledgeable and was able to provide key information and scenarios that would help me reach my goals.

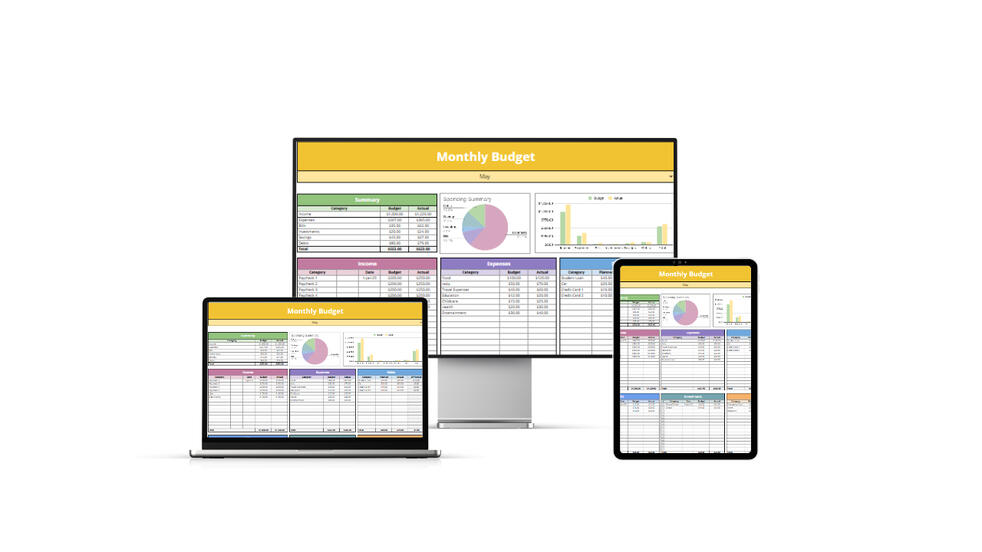

Tools to Help You Plan for Homeownership

I’m a mortgage loan officer. Start with my free mortgage calculator to see your numbers, then grab my $5 budget and savings tools to stay on track toward buying a home.

saving tracker

yearly budget

monthly budget

budget 50/20/30

Nexa Mortgage, LLC

Company NMLS #1660690

AZ Mortgage Banker License #0944059

Office Address:

5559 S Sossaman Rd, Bldg #1, Ste #101

Mesa, AZ 85212

Kiera Thomas

Branch Manager

NMLS #1922562

Phone: (318) 935-9833

Email: [email protected]